The present world is steeped in trouble galore. The present scenario demands any kind of entertainment which is refreshing. Hdhub4u, is fulfilling our desires. It permits people to download movies according to their choice. Movies are a source of entertainment and refreshment for all of us.

Know in detail about Hdhub4u.

It is an Indian website, which uploads a variety of content. Although it is an Indian website, it has spread Worldwide. Movies are downloaded through this website from all over the world. It has posed stiff competition to many movies and TV shows because of its popularity.

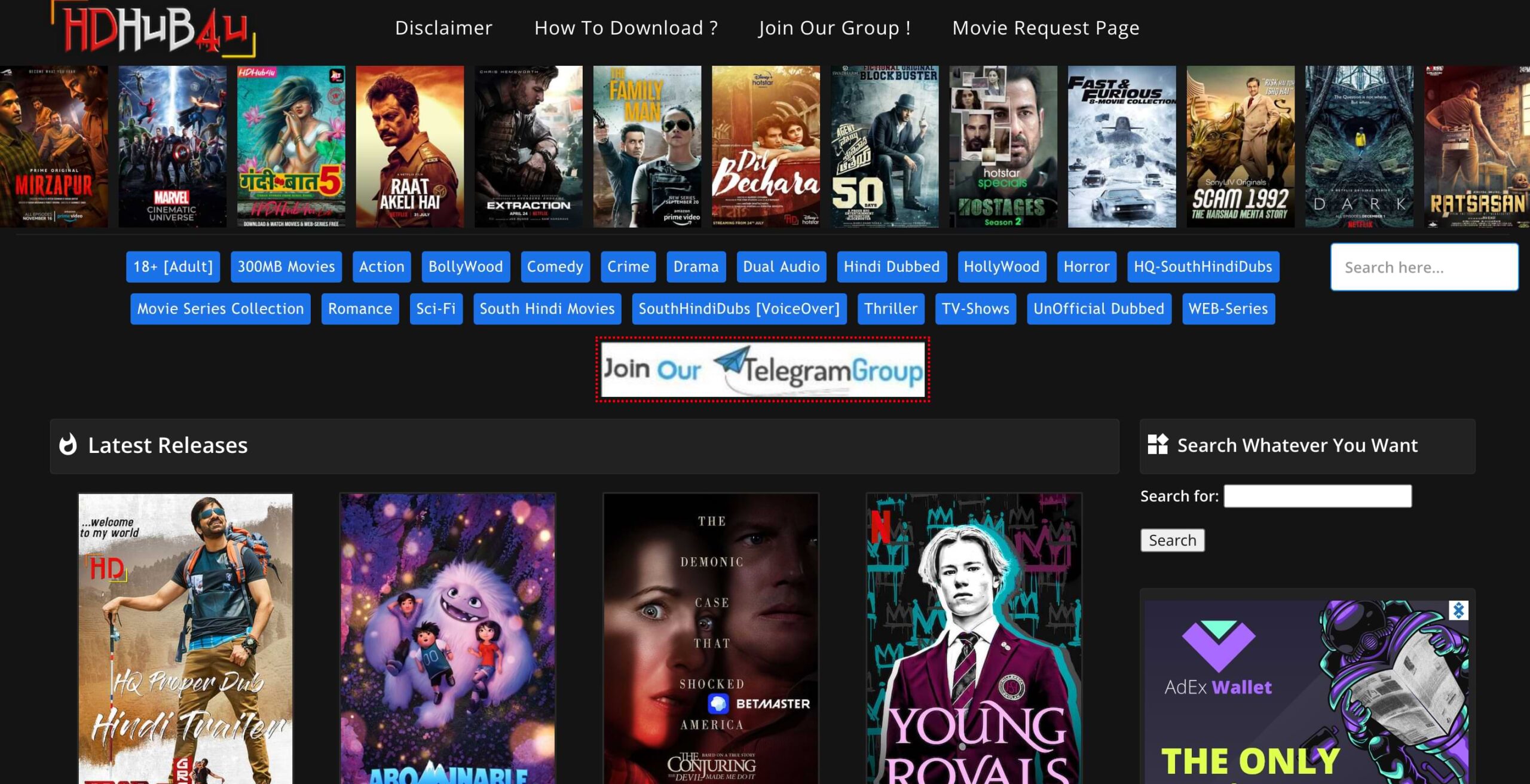

The Segments or sections it carries

It is a power-packed, content-loaded website, which has in store all kinds of movies. It contains

- Hollywood films

- Bollywood films

- Kollywood films( Film industry in the South)

- Molly Wood (Malayalam Film Industry).

- Tollywood.( Bengali Film industry)

- Action-packed films

- Animated films

- Horror films

- Thriller films

- Romantic films

- Web-based series

- WWE

- Sci-fi films and many others.

Featured films in hdhub4u

It is famously known to host films, and short webs soon after its release. It made it possible for many popular, huge-budget films to download from their website. Newly released, big brand movies like 365 Days, the film Thappad, Web Series like Baarish( part 2), and the film Mrs Serial Killer are made available on this website.

Also, Punjabi, Telugu, and Marathi movies are also available.

About its popularity

It is gaining immense popularity over the years. It gained a huge number of traffic globally in the Alexa Rank. Alexa Rank is a site that generates statistical data on numerous websites globally.

The rank provided by Alexa is counted on the number of internet browsers throughout the world. In view of its latest research, the website’s popularity or traffic has increased considerably. Alexa also found that a number of website pages are browsed daily. The time allotted by each user is also rising.

The total worth of hdhub4u.

It has accumulated a total amount of numerous US dollars. This estimated figure, which was researched by WorthofWeb, furnishes details of numerous sites depending on their net worths.

The figure given by WorthofWeb on hdhub4u, is counted on its revenue collected through advertisement. Advertisement is based on the website’s popularity and order of ranking, including data collected from Alexa. Its estimated revenue from advertising is also a considerable amount annually depending on the number of visits every year.

A quick peep into its contents.

It is a vast storehouse from general topics to superhit content.

If you wish to look into some dubbed releases as well as other refreshments then you are free to watch-

- Bheeshma Hindi Dubbed Full Movie

- Godzilla vs Kong Tamil Dubbed Movie.

- Midnight in the Switchgrass( Hindi dubbed movie) and English.

- The Hitman’s Wife’s Bodyguard ( Hindi Dubbed).

- Disco Raja( Hindi Dubbed)

- Coke Studio

- PFDC Sunsilk Fashion Week

- Bridal Couture Week and many more are on the list.

Can films be downloaded on mobiles?

Films can be downloaded and viewed on mobile phones because they are available in many sizes. In mobile phones, movies should have small measures, which are available in it, and other different sizes are also available.

It has become increasingly popular among film watchers. For those who have a passion to explore different kinds of movies, this website becomes their first choice.

Although the internet is deluged with websites that allow users to download movies, they do not possess a vast amount of content. Hdhub4u offers movies and shows in all languages. It provides everything under one roof. So it attracts more users and becomes their favorite download platform.

Tags:

#HDHub4u